how to pay meal tax in mass

The meals tax rate is 625. Massachusetts charges a sales tax on meals sold by restaurants or.

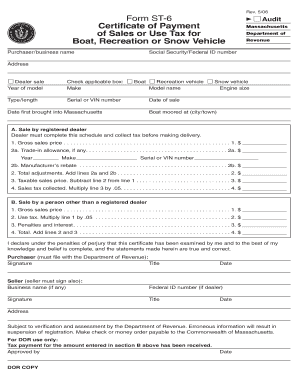

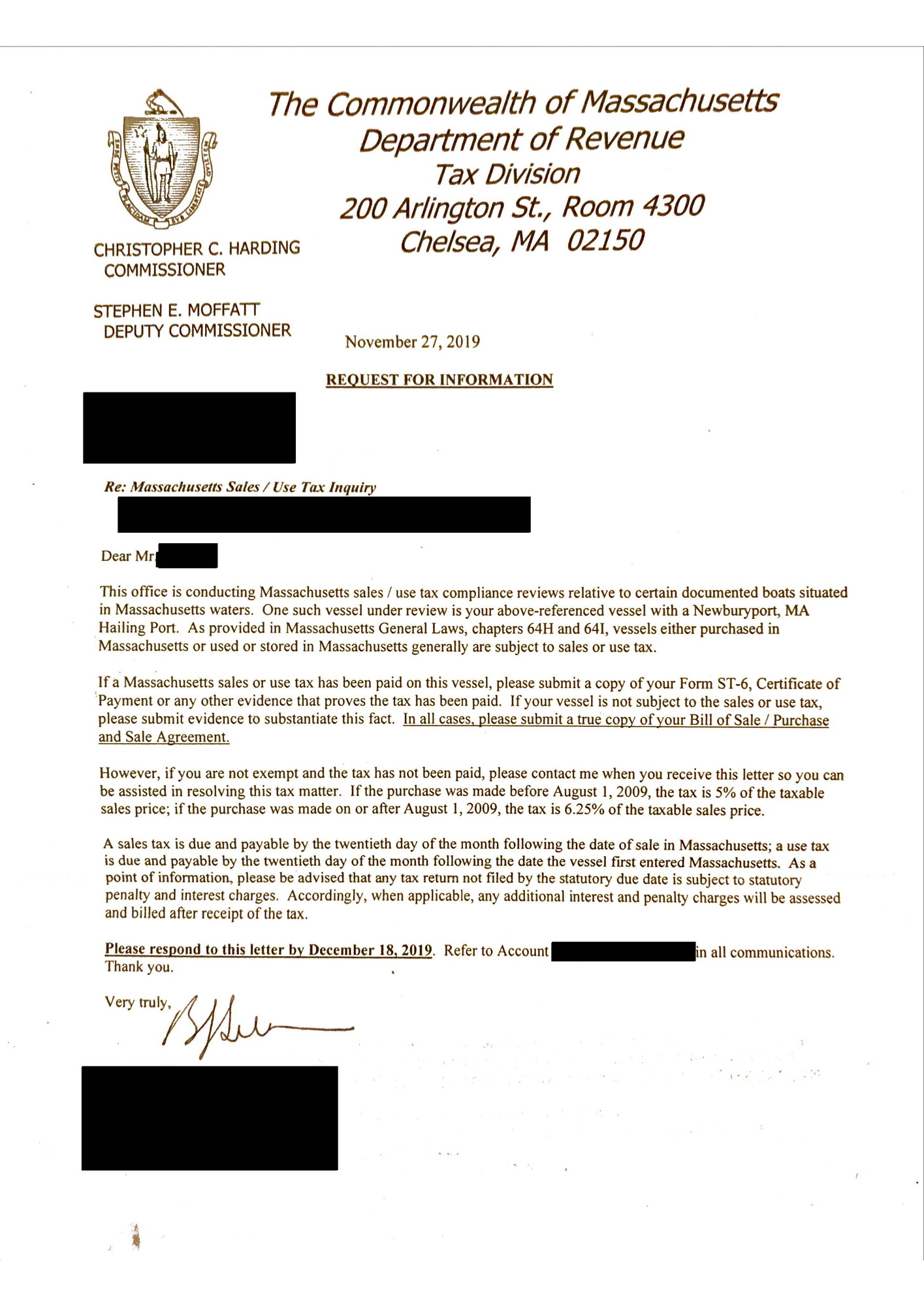

Sales And Use Tax On Boats Recreational Off Highway Vehicles And Snowmobiles Mass Gov

How to pay meal tax in mass Tuesday May 3 2022 Edit.

. In Massachusetts the state charges a 625 sales. On a 100 restaurant check a customer would pay an extra 75 cents. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

So you would simply charge the state sales tax rate of 625 to buyers in. The local meals tax does not increase restaurant bills significantly. The states room occupancy excise tax rate is 57.

In Massachusetts there is a 625 sales tax on meals. In addition to the state. The maximum tax that can be enacted on meals in.

More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Bier Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. Sales tax on meals prepared food and all beverages.

Massachusetts local sales tax on meals. Generally food products people commonly think of as. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

The Commonwealth of Massachusetts allowed municipalities to levy this 075 percent tax in an addition to the state-levied 625 percent meals tax in order to help offset. A Haverhill Massachusetts Meals Tax Restaurant Tax can only be obtained through an authorized. Generally food products people commonly think of as.

Restaurant owners are subject to multiple tax obligations. The maximum tax that can be enacted on meals in. Massachusetts doesnt have local sales tax rates only a statewide tax rate of 625.

In addition to state and federal income tax localities may also impose sales taxes. Meals are sold by. Sales of meals to Harvard students are tax-exempt if.

In Massachusetts there is a 625 sales tax on meals. The meals tax rate is 625. Sales of meals to Harvard faculty and staff are taxable.

Tax Free Weekend August 13 14 2022 Mass Gov

Is Shipping Taxable In Massachusetts Taxjar

How To File And Pay Sales Tax In Massachusetts Taxvalet

Form St 6 Certificate Of Payment Of Sales Or Use Tax For Mass Gov Fill And Sign Printable Template Online

Massachusetts Sales Tax The Hull Truth Boating And Fishing Forum

Mass Will Collect Sales Taxes On Online Purchases Wbur News

Massachusetts Sales And Use Tax For The Construction Industry Webcast Feeley Driscoll P C Youtube

Massachusetts Sales Tax Guide For Businesses

Massachusetts Sales Tax Non Resident Income Sourcing Changes O Connor Drew P C

Massachusetts Sales Tax Filing Update October 2019 Taxjar Support

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

As Massachusetts Analysts Take Stock Of Economic Toll Of Coronavirus Report Makes Case For Baker S Sales Tax Modernization Proposal Masslive Com

How To Register File Taxes Online In Massachusetts

Five Taxes Your Heirs May Pay Or Not After Your Death Ssb Llc Samuel Sayward Baler Llc Dedham Ma Lawyers

How Does The Ma Sales Tax Compare Massbudget